In a strategic partnership, Greenmoons and Sabuy Connext Tech Public Company Limited have developed the meID Super Application, featuring the meHome module—a groundbreaking solution aimed at enhancing customer relationships and facilitating customers to manage their installment plan for their home appliance purchase.

The Challenge and Solution

Client Background: Sabuy Connext Tech, known for its strong offline sales for home appliances under brand ‘Safe’, faced significant challenges with overdue payments and inefficient customer service, impacting financial health and customer loyalty.

Solution Overview: The meID Application, specifically the meHome module, was designed to revolutionize home appliance management and financial transactions. This comprehensive platform integrates home automation monitoring, installment payment management, and an online shopping channel to offer a seamless user experience for replacement or spare part ordering.

The KYC process, or “Know Your Customer,” has been implemented to verify the identity of customers. The aim of the KYC process is to prevent identity theft, financial fraud and in this case, it enhance ability for Sabuy Connext Tech to be able to track and contact customers on payment.

Our KYC process involves:

- Identity Verification: customers needs to provide valid government-issued ID cards. We require a photograph to be taken during the verification process to match the person with their ID documents. This is verified by Department of Provincial Administration of Thailand.

- Address Verification: This involves proving the customers’ residential address

- Phone Verification : We implement OTP (One-Time Passcode) to validate their phone

- Biographical Information: This includes collecting data on the customers’ date of birth, nationality and other information that helps further verify their identity.

Outcomes

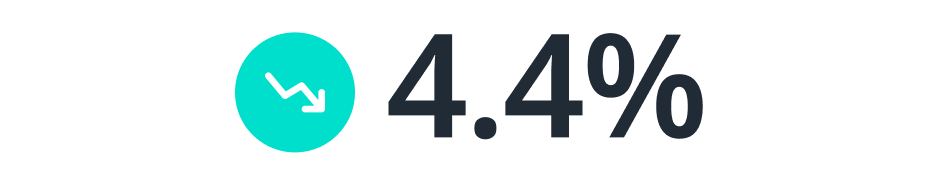

Reduced bad debt from 24%

Increased on-time payment rates from 67%

Achieved an adoption rate among new customers

Key Features and Benefits:

- KYC Verification Process : Through this process, it screens out potential fraud

- Installment Payment Management: Customers can track payment statuses, receive reminders, and make payments via QR codes, significantly lowering the incidence of overdue payments

- Enhanced Customer Engagement: The app keeps customers informed and engaged with product registration, notifications for replacements, and news and promotions.

- Streamlined Technician Appointments: The app simplifies scheduling for installation and maintenance, improving efficiency and customer satisfaction.

The meID app has reshaped how Sabuy Connext Tech manages customer interactions and financial transactions, leading to improved financial health and stronger customer relationships. This case study exemplifies the potential of targeted digital solutions to transform business operations and customer experiences significantly.

For more information on how the meID application can enhance your business operations, visit meID Application to learn more and get started.

Visuals → Wireframe, actual app on the payment and reminder, KTV video process (if possible)